Growing Market for Soda Ash in India: A Synopsis

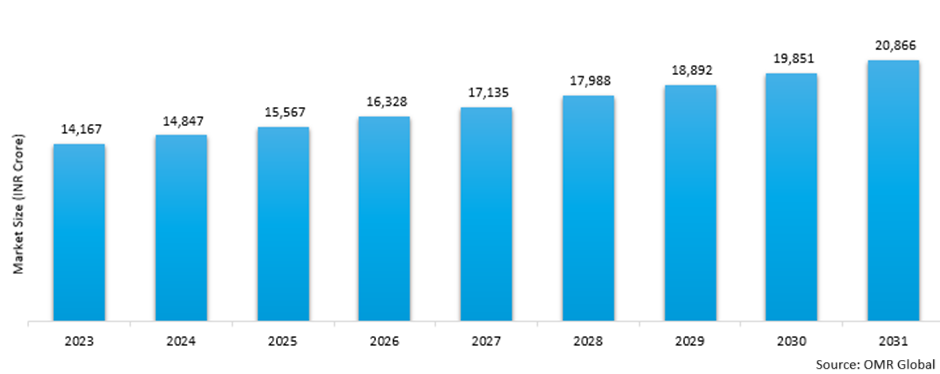

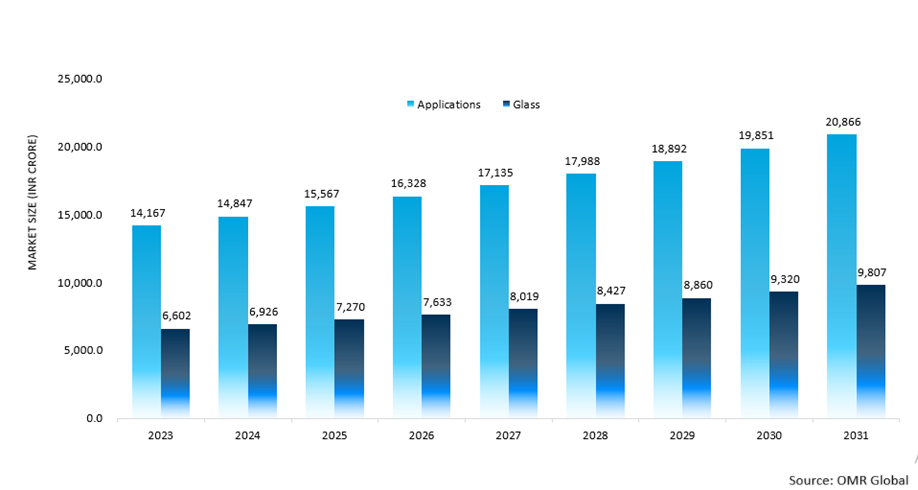

Sodium carbonate or soda ash is an alkali chemical widely available in numerous grades that differ primarily in bulk density. Soda ash encompasses a wide range of applications across various industries, including glass, soaps & detergents, chemicals, metallurgy, and paper & pulp, which is contributing significantly towards the market growth. It is used as a disinfectant in industries. It is a key raw material used to manufacture lithium-ion batteries and solar glass. Soda ash is an essential component in water treatment. It also has domestic applications, such as cleaning stains in homes. Indian soda ash market is projected to reach INR 20,866 crore in 2031 from INR 14,167 in 2023, growing at a CAGR of 5.0% during the forecast period (2024-2031). The total size of the Indian soda ash market, by volume, is about 42.0 Lac MT (Metric Ton). The total installed capacity of Soda Ash in India is 44.5 Lac MT, with an estimated production of about 35.7 Lac MT in 2023-24.

Indian Soda Ash Market Research and Analysis, 2023-2031 (INR Crore)

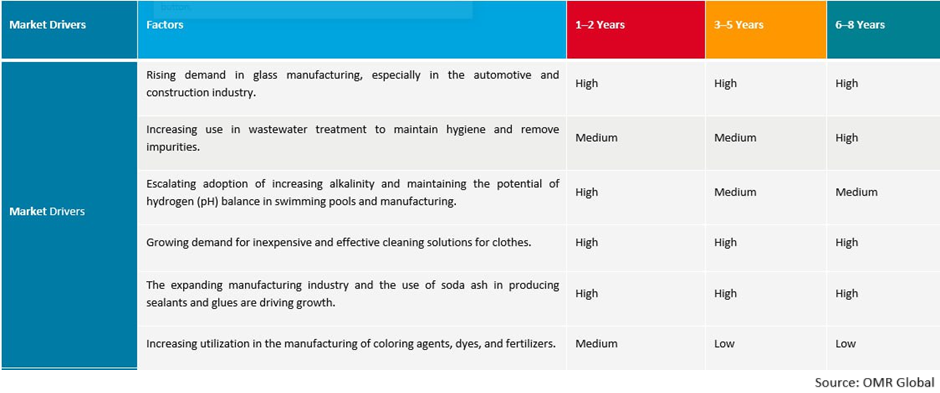

Soda ash provides an effective, economical, and beneficial alternative to harsh chemical cleaners, for a variety of domestic and industrial purposes. Thus, it is widely used in the detergent industry. The market growth is driven by a variety of factors, including, an increase in glass manufacturing, accelerating demand for water treatment, increasing need for balancing the potential of hydrogen (pH) balance of water, rising manufacturing of dyes, coloring agents, and fertilizers, accelerating demand in the manufacture of sealants and glues.

Drivers of Soda Ash Market: Impact Analysis

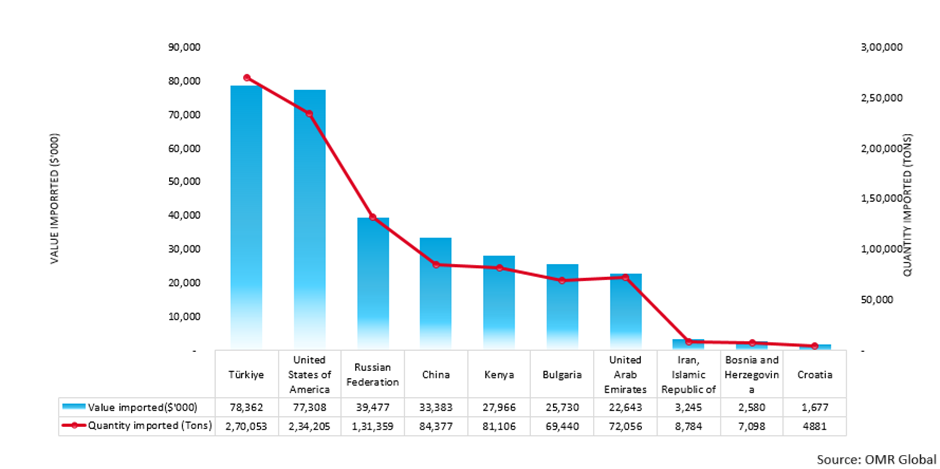

The global soda ash capacity in 2023 was reported to be around 73.00 million MT (MMT). Global demand was reported at around 67.8 MMT showing a growth of 2.7% in 2023 over last year. However, the soda ash production growth in India has witnessed a slight decline, in 2023-24, contrary to its rising demand in the region. This is attributed to the increasing preference for soda ash imports in the area. Currently, almost 25.0% of the Indian demand is being met by imports. The industry reported lower production of around 5.1% (2 Lac MT) compared to 2022 levels mainly, owing to the surge of imports mainly from Turkey, the US & Russia. Total imports into India were at 10.42 Lac MT as compared to 6.36 Lac MT in 2022 an increase of 64.0%. Exports also increased to 4.18 Lac MT up from 2.16 Lac MT last year an increase of 94.0%.

Supplying Markets of Soda Ash to India in 2023

In 2023, Turkey was the major exporter of soda ash to the Indian market. It exported 270,053 tons of soda to India, valued at $78,362 thousand. It is closely followed by the US, with an export quantity of 234,205 tons, amounting to $77,308 thousand. Both, Turkey and the US, hold around 25.0% share in India’s imports. Iran, Bosnia and Herzegovina, and Croatia, hold the lowest share (1.0%) in India’s imports.

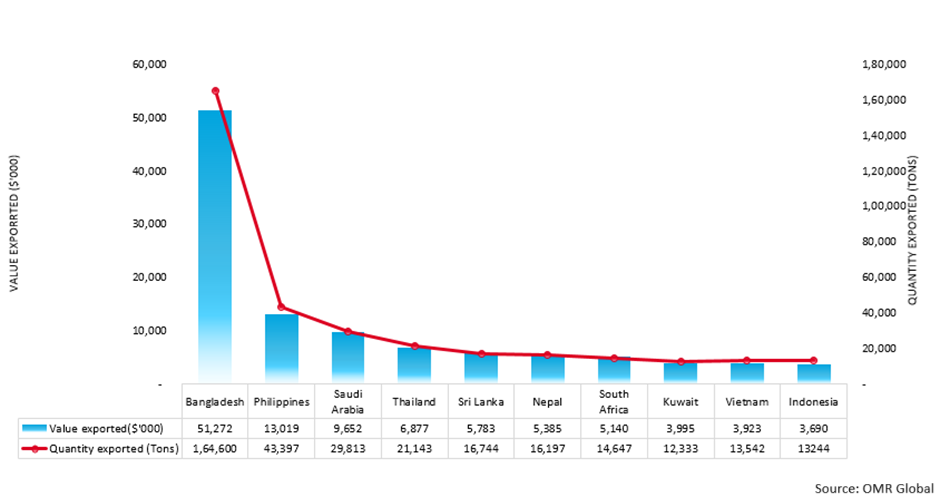

Importing Markets of Indian Exported Soda Ash Products in 2023

Bangladesh presents a considerable opportunity for the Indian manufacturers of soda ash. In 2023, the country imported 164,600 tons of soda ash from the Indian market, valued at $51,272 thousand. Bangladesh constitutes 39.0% of India's exports of soda ash. Additionally, Kuwait, Vietnam, and Indonesia hold the share in India's exports, of around 3.0%, $3,995 thousand, $3,923 thousand, and $3,690 thousand, respectively.

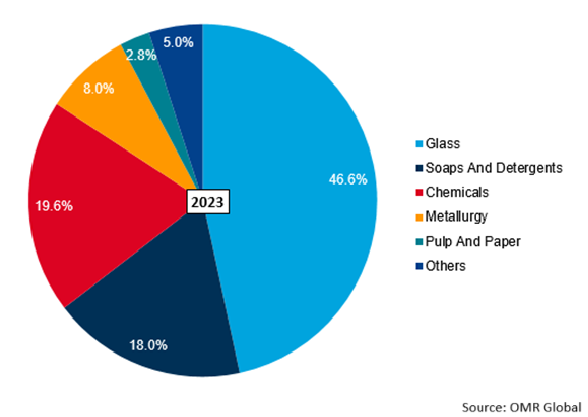

Highest Performing Segment by Application (2023-2031)

Soda ash is in high demand in the glass industry, as it reduces the energy consumption for glass manufacturing. It is used in the manufacturing of a variety of glasses including, flat, container, and specialty glass. The glass industry has witnessed tremendous growth in the past years attributed to the rising demand in the construction and automotive industries. The construction industry is growing owing to infrastructural development in emerging economies, such as India. The rise in the global production and sales of vehicles, particularly in Asian countries and Central and South America, is contributing to market growth.

Soda Ash Market by Application, 2023 (%)

However, the low-priced imports from China and Vietnam are constraining the growth of the flat glass segment. China exported 84,377 tons of soda ash to India, valued at $33,383 thousand, in 2023. Additionally, the solar glass industry which previously was anticipated as a high-growth sector, has also been adversely impacted by the inexpensive imports, severely impacting future investment in the sector. Thus, the Indian soda ash market is seeking refuge in the slow and gradual increase in the demand from the soap & detergents, and chemical segments. The chemical segment alone is growing at a CAGR of 6.0%.

The high prices of soda ash in the region are primarily attributed to the oligopolistic market structure, with only a few firms dominating the market. Almost all the major industry players are located in the state of Gujarat, owing to its proximity ascertaining the ready availability of the main raw materials namely limestone and salt. Additionally, GHCL is the only player in the industry to have its lignite mines.

However, this results in huge freight for customers in the southern and eastern regions. The average freight to customers in the southern and eastern regions from the western region (Gujarat) is approximately $50/ton, whereas the average freight for imports ranges between $25/ton-30/ton. Due to this difference between domestic and imported soda ash, imported soda ash becomes attractive for eastern and south India-based customers. High diesel prices further aggravate the situation.

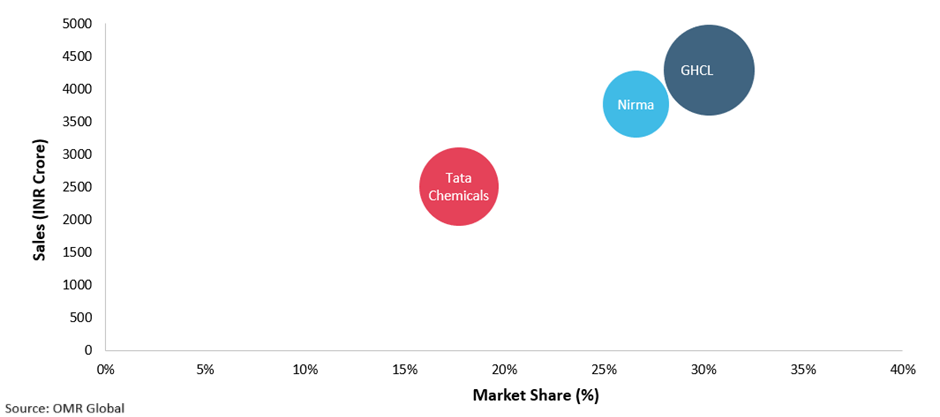

Competitive Landscape (2023)

It is evident from the above figure that GHCL is a major player in the Indian soda ash market. In 2023, GHCL reported a production capacity of 1200 KTons of soda, greater than its competitors Tata Chemicals and Nirma, holding a production capacity of 917 KTons, and 650 KTons respectively. Additionally, GHCL held the largest revenue share (among the three), amounting to INR 4,288.4 crore, in 2023, followed by Nirma (INR 3,768.0 crore), and Tata Chemicals (INR 2,509.0 crore). GHCL, Nirma, and Tata Chemicals hold 30.2%, 26.60%, and 17.71%, market shares, explaining their industry dominance.

The other market players include Tata Chemicals, Nirma, Hindustan Unilever Limited, Ghari Group, P&G, Patanjali Ayurved Limited, Fena Group, HNG Group, Gujarat Guardian Limited, Gujarat Borosil Limited, Piramal Glass Limited, Gold Plus Glass Industries Limited and Phillips.

The demand for soda ash is increasing at a moderate rate in the Indian market. The soda ash demand accounted for 4,305 thousand tons in 2023 and is anticipated to reach 5,138 thousand tons in 2031, growing at a CAGR of 2.3%. However, the average selling price is growing at a faster CAGR of 2.7%, with the selling price of INR 32,908 per ton in 2023, reaching INR 40,611 per ton in 2031.

Encapsulating, the Indian soda ash market is anticipated to grow, attributing to the rising demand in various industries, majorly in the chemical, and the soap & detergent industries. However, the industry depends heavily on imports, contracting its potential contribution to the growth of the economy. The concentration of the market in a small territory is largely affecting the market growth. This also challenges the introduction of the new players to the market, directing the control to a few players, and affecting the pricing of the final products. Thus, a focus on the cost-cutting and exploration of novel sites for the acquisition of raw materials can play a pivotal role in the growth of the Indian soda ash market. The availability of cost-effective soda ash products can lead to the rise of new entrants in this highly dominated industry.